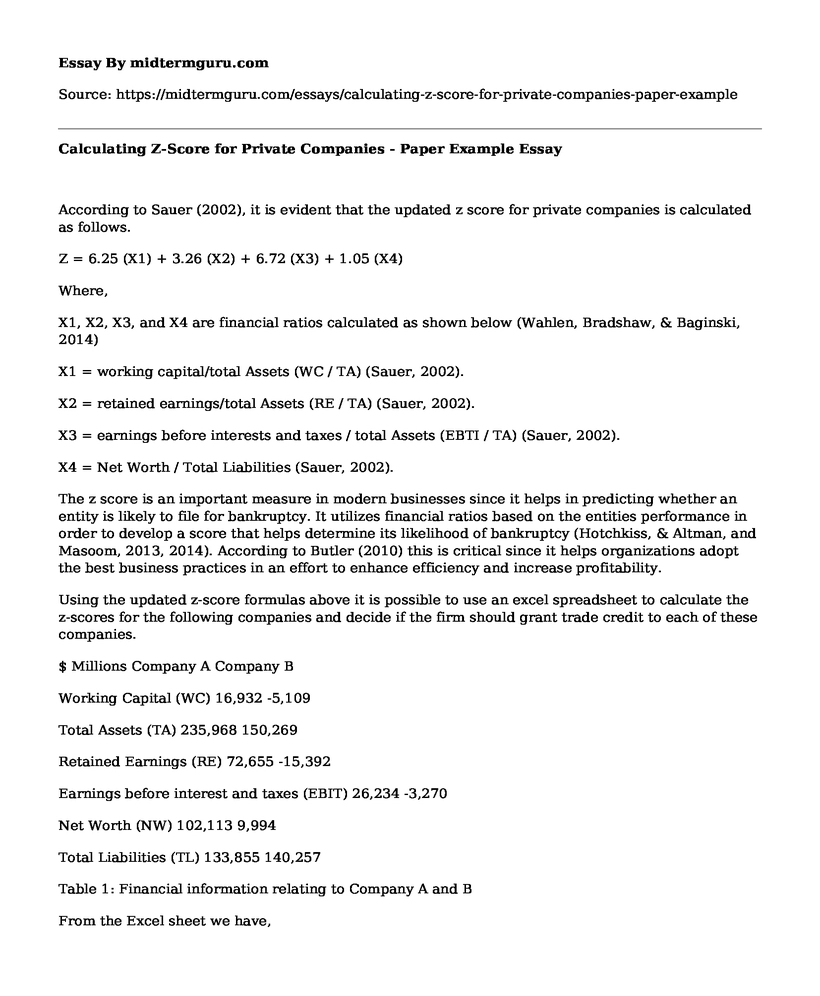

According to Sauer (2002), it is evident that the updated z score for private companies is calculated as follows.

Z = 6.25 (X1) + 3.26 (X2) + 6.72 (X3) + 1.05 (X4)

Where,

X1, X2, X3, and X4 are financial ratios calculated as shown below (Wahlen, Bradshaw, & Baginski, 2014)

X1 = working capital/total Assets (WC / TA) (Sauer, 2002).

X2 = retained earnings/total Assets (RE / TA) (Sauer, 2002).

X3 = earnings before interests and taxes / total Assets (EBTI / TA) (Sauer, 2002).

X4 = Net Worth / Total Liabilities (Sauer, 2002).

The z score is an important measure in modern businesses since it helps in predicting whether an entity is likely to file for bankruptcy. It utilizes financial ratios based on the entities performance in order to develop a score that helps determine its likelihood of bankruptcy (Hotchkiss, & Altman, and Masoom, 2013, 2014). According to Butler (2010) this is critical since it helps organizations adopt the best business practices in an effort to enhance efficiency and increase profitability.

Using the updated z-score formulas above it is possible to use an excel spreadsheet to calculate the z-scores for the following companies and decide if the firm should grant trade credit to each of these companies.

$ Millions Company A Company B

Working Capital (WC) 16,932 -5,109

Total Assets (TA) 235,968 150,269

Retained Earnings (RE) 72,655 -15,392

Earnings before interest and taxes (EBIT) 26,234 -3,270

Net Worth (NW) 102,113 9,994

Total Liabilities (TL) 133,855 140,257

Table 1: Financial information relating to Company A and B

From the Excel sheet we have,

For company A, the ratios X1, X2, X3, and X4 are as calculated below.

X1 = working capital / total Assets (WC / TA) = (16,932 / 235,968) = 0.071755492

X2 = retained earnings / total Assets (RE / TA) = (72,655 / 235,968) = 0.307901919

X3 = earnings before interests and taxes / total Assets (EBTI / TA) = (26,234 / 235,968) = 0.111176092

X4 = Net Worth / Total Liabilities = (102,113 / 133,855) = 0.762862799

For company B, the ratios X1, X2, X3, and X4 are as calculated below.

X1 = working capital / total Assets (WC / TA) = (-5,109 / 150,269) = -0.033999028

X2 = retained earnings / total Assets (RE / TA) = (-15,392 / 150,269) = -0.102429643

X3 = earnings before interests and taxes / total Assets (EBTI / TA) = (-3,270 / 150,269) = -0.021760975

X4 = Net Worth / Total Liabilities = (9,994 / 140,257) = 0.071245767

Company A Company B

X1 0.071755492 -0.033999028

X2 0.307901919 -0.102429643

X3 0.111176092 -0.021760975

X4 0.762862799 0.071245767

Table 2:

Hence, the z-score becomes

For company A,

Z = 6.25 (X1) + 3.26 (X2) + 6.72 (X3) + 1.05 (X4)

= 6.25 (0.071755492) + 3.26 (0.307901919) + 6.72 (0.111176092) + 1.05 (0.762862799)

= 3.000341

For company B,

Z = 6.25 (X1) + 3.26 (X2) + 6.72 (X3) + 1.05 (X4)

= 6.25 (-0.033999028) + 3.26 (-0.102429643) + 6.72 (-0.021760975) + 1.05 (0.071245767)

= - 0.61784

Discussion and conclusion

From the calculation carried out above, it is clear that company A has a z score of 3.000341 while company B has a z score of - 0.61784. Based on the interpretation provided by Sauer (2002) we conclude that Company A is safe while Company B is bankrupt. This is mainly because company A has a z score value that is greater than 2.6 which is considered safe. On the other hand, company B has a z score value that is less than 1.1, which is considered not safe (bankrupt) (Sauer, 2002). This indicates that company A is currently in a strong financial position to maintain its day-to-day operations. The results also show that company Bs financial position is weak and may be unable to maintain its day-to-day operations, as well as, meet its financial obligations hence it may file for bankruptcy (Livingstone & Grossman, 2009).

Recommendations

As discussed above, the results indicate that company A is safe from bankruptcy while company B is not. Therefore, the firm should grant trade credit to company A while denying the same credit to company B. The main reason for this recommendation is that the results show that company A is in a strong financial position hence is in a position to meet the obligations of the trade credit extended to it. On the other hand, company Bs financial position is weak as indicated by its z score, which predicts that the company is headed for bankruptcy. This means that the company may not be in a position to meet the obligations of the trade credit extended to it.

Reference List:

Butler, J. W. 2010. Navigating today's environment: The directors' and officers' guide to restructuring. London: Globe White Page Ltd.

Hotchkiss, E., & Altman, E. I. 2013. Corporate financial distress and bankruptcy: Predict and avoid bankruptcy, analyze and invest in distressed debt. Hoboken, N.J: Wiley.

Livingstone, J. L., & Grossman, T. 2009. The Portable MBA in finance and accounting. Hoboken, NJ: Wiley and Sons.

Masoom, K. 2014. The entrepreneurs' dictionary of business and financial terms. Singapore: Partridge Publishing.

Sauer, T. G. 2002. How May We Predict Bankruptcy? Business Credit Selected Topic, 104, 16 17

Wahlen, J. M., Bradshaw, M. T., & Baginski, S. P. 2014. Financial reporting, financial statement analysis, and valuation. Australia : South-Western

Cite this page

Calculating Z-Score for Private Companies - Paper Example. (2021, May 31). Retrieved from https://midtermguru.com/essays/calculating-z-score-for-private-companies-paper-example

If you are the original author of this essay and no longer wish to have it published on the midtermguru.com website, please click below to request its removal:

- Ethics and Sustainability Ford Motors Company - Paper Example

- AT&T Inc Company Financial Analysis Paper Example

- Paper Example on Pros and Cons of National Health Insurance

- The Comparison of Interest and Credit in the Medieval Italian Banks

- Research Paper on Classical Exchange-Traded Funds

- Private Equity Investment: Increasing Investor Diversification Benefits - Essay Sample

- Behavioral Finance: Psychology of Investors and Market Impact - Essay Sample