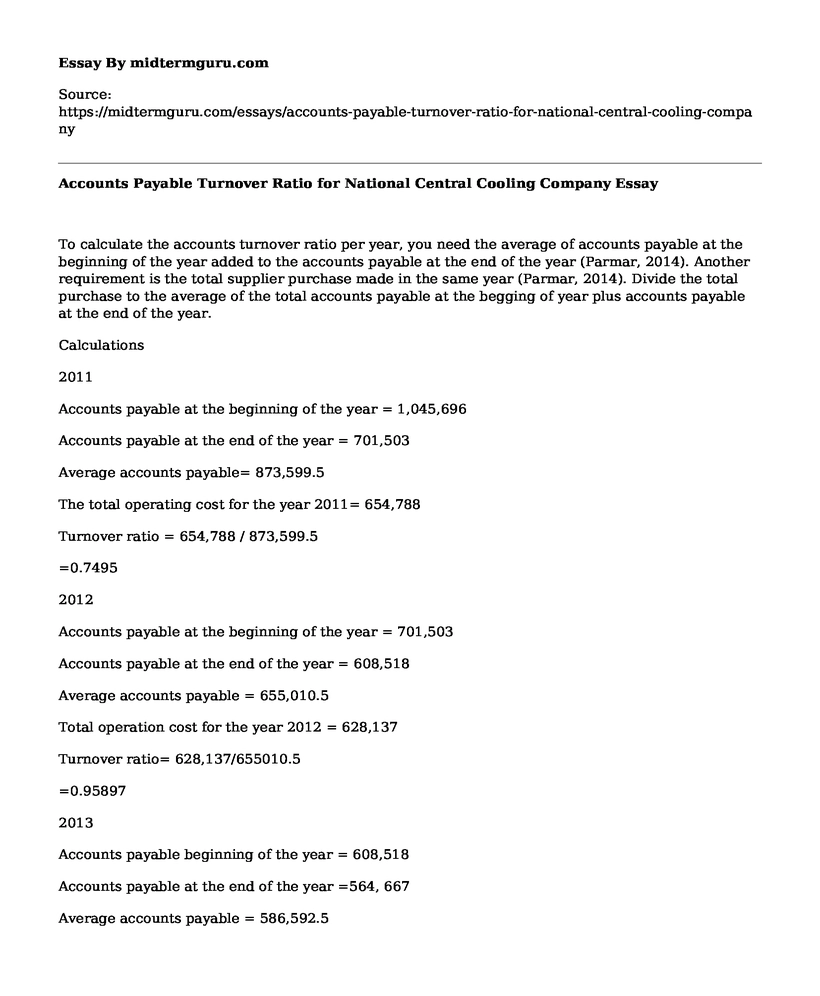

To calculate the accounts turnover ratio per year, you need the average of accounts payable at the beginning of the year added to the accounts payable at the end of the year (Parmar, 2014). Another requirement is the total supplier purchase made in the same year (Parmar, 2014). Divide the total purchase to the average of the total accounts payable at the begging of year plus accounts payable at the end of the year.

Calculations

2011

Accounts payable at the beginning of the year = 1,045,696

Accounts payable at the end of the year = 701,503

Average accounts payable= 873,599.5

The total operating cost for the year 2011= 654,788

Turnover ratio = 654,788 / 873,599.5

=0.7495

2012

Accounts payable at the beginning of the year = 701,503

Accounts payable at the end of the year = 608,518

Average accounts payable = 655,010.5

Total operation cost for the year 2012 = 628,137

Turnover ratio= 628,137/655010.5

=0.95897

2013

Accounts payable beginning of the year = 608,518

Accounts payable at the end of the year =564, 667

Average accounts payable = 586,592.5

Operations cost for the year 2013= 592,127

Turnover ratio= 592,127 / 586,592.5= 1.009

2014

Accounts payable beginning of the year = 564,667

Accounts payable at the end of the year = 521,381

Average accounts payable = 543,024

Total operations cost for the year 2014 = 597, 020

Turnover ratio 2014 = 597,020 / 543,024

= 1. 099

2015

Accounts payable beginning of the year = 521,381

Accounts payable at the end of the year = 568,001

Average accounts payable = 544,691

Total operation cost for the year 2015 = 611,235

Turnover ratio = 611,235 / 544,691

= 1.122

Profit margin ratio

To get the profit margin ratio, divide the net income by the net sales. Net income is the total revenues subtract the total expenses. Net sales is the remainder after subtracting refunds from the gross sales.

2011

Net income = total revenue operational cost

1,114,571 654,788 = 459,783

Net sales = 466,135 (The balance at the end of the year for the capital work in progress).

Profit margin ratio = Net income / Net sales

= 459, 783 / 466, 135

= 0.9864

2012

Net income = Total revenue Operational cost

1,128,738 -628,137 = 500,601

Net sales = 110,829 (The balance at the end of the year for the capital work in progress).

Profit margin ratio = Net income / Net sales

= 500,601 / 110, 829

= 4.51688

2013

Net income = Total revenue Operational cost

1,100,188 592,127 = 508061

Net sales = 450,582 (The balance at the end of the year for the capital work in progress).

Profit margin ratio = Net income / Net sales

= 508,061 / 450,582

=1.12756

2014

Net income = Total revenue Operational cost

=1,130,612 597,020 =533592

Net sales = 157,117 (The balance at the end of the year for the capital work in progress).

Profit margin ratio = Net income / Net sales

= 533592 / 157,117

= 3.396

2015

Net income = Total revenue Operational cost

= 1,171,850 611,235 = 560615

Net sales = 304,723 (The balance at the end of the year for the capital work in progress).

Profit margin ratio = Net income / Net sales

= 560,615 / 304,723

= 1.83975

Column charts

Account payable turnover ratio and profit margin ratio

Analysis

The Accountable payable turnover ratio is a business tool that is used to evaluate the speed with which supplies are paid (Parmar, 2014). By use of this tool, one can determine the financial conditions of the company or business organization. From the data above, the turnover ratio increased from one year to the other indicating a good financial condition of the company.

On the profit margin ratio analysis, this ratio is used to measure the amount of income collected after every sale (Parmar, 2014). This ratio measures the profitability of the sales after deducting the expenses of the company (Parmar, 2014). It also measures the effectiveness of converting sales into net income (Parmar, 2014). From the chart above, the profit margin ratio has declined in some years like 2011, 2013, and 2015 compared to 2012 and 2014. A decline in profit margin ratio indicates that the company is making a small net income while a higher profit margin income indicates that more net income is being generated from the sales.

References

Parmar, V. (2014). Analysis Of Financial Statements: Understanding of Financial analysis,

Open Interest analysis, Ratio analysis and Equity analysis. Saarbrucken: LAP

LAMBERT Academic Publishing.

Cite this page

Accounts Payable Turnover Ratio for National Central Cooling Company. (2021, May 24). Retrieved from https://midtermguru.com/essays/accounts-payable-turnover-ratio-for-national-central-cooling-company

If you are the original author of this essay and no longer wish to have it published on the midtermguru.com website, please click below to request its removal:

- Sony Corporation in Australia - Paper Sample

- Evaluation Essay on Blockbuster Company

- Influencing Factors of Life Insurance Premium Income at Home and Abroad

- How the USA Does Business with Other Countries - Research Paper

- Paper Example on AAA HotelCo Representatives

- Evaluation Essay on Under Armour

- Creating a Recruitment Plan for R.J. Reynolds Tobacco Company - Research Paper