AT&T Inc. (T) Company is an American giant telecommunications company headquartered in Whitacre Tower in Dallas, Texas (Vault, n.d). According to McFarlane (2015), AT&T offers wireless, fixed telephone, data and video services to its US subscribers. Its principal competitors include Comcast Corporation, Cox Communications, DISH Network Corporation, Charter Communications, Level 3 Communications well as SAVVIS, Inc (Fried, 2016). The analysis of trend and performances of the company over the period of the past ten years has been as follows:

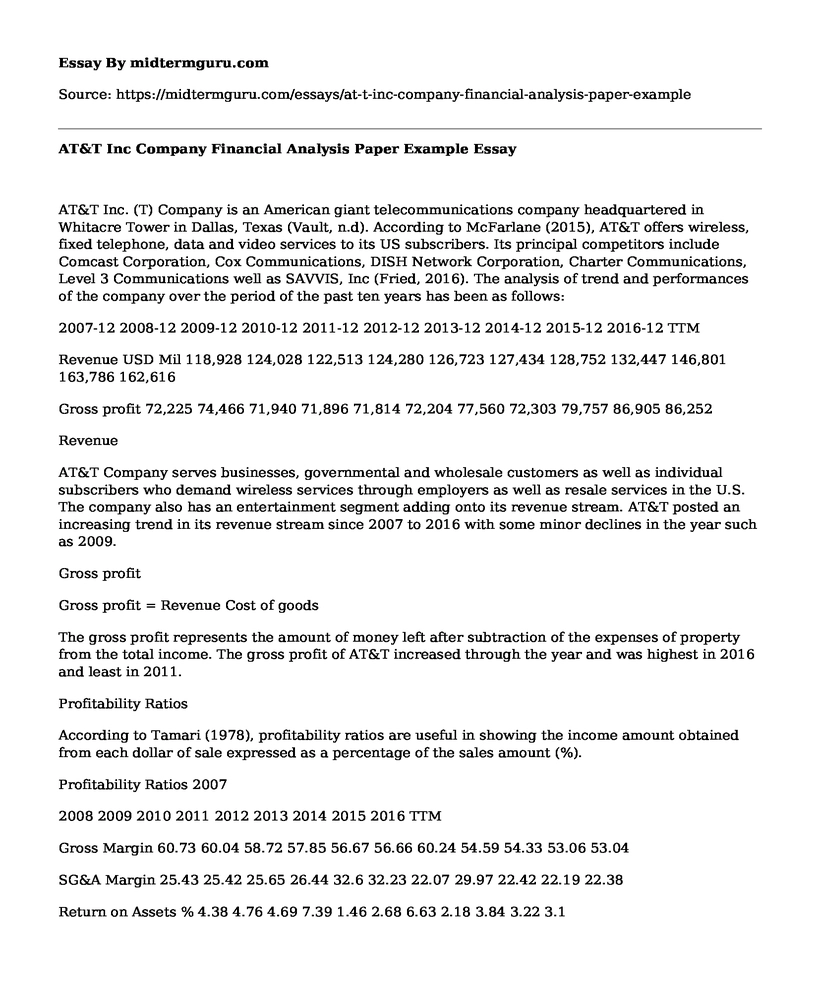

2007-12 2008-12 2009-12 2010-12 2011-12 2012-12 2013-12 2014-12 2015-12 2016-12 TTM

Revenue USD Mil 118,928 124,028 122,513 124,280 126,723 127,434 128,752 132,447 146,801 163,786 162,616

Gross profit 72,225 74,466 71,940 71,896 71,814 72,204 77,560 72,303 79,757 86,905 86,252

Revenue

AT&T Company serves businesses, governmental and wholesale customers as well as individual subscribers who demand wireless services through employers as well as resale services in the U.S. The company also has an entertainment segment adding onto its revenue stream. AT&T posted an increasing trend in its revenue stream since 2007 to 2016 with some minor declines in the year such as 2009.

Gross profit

Gross profit = Revenue Cost of goods

The gross profit represents the amount of money left after subtraction of the expenses of property from the total income. The gross profit of AT&T increased through the year and was highest in 2016 and least in 2011.

Profitability Ratios

According to Tamari (1978), profitability ratios are useful in showing the income amount obtained from each dollar of sale expressed as a percentage of the sales amount (%).

Profitability Ratios 2007

2008 2009 2010 2011 2012 2013 2014 2015 2016 TTM

Gross Margin 60.73 60.04 58.72 57.85 56.67 56.66 60.24 54.59 54.33 53.06 53.04

SG&A Margin 25.43 25.42 25.65 26.44 32.6 32.23 22.07 29.97 22.42 22.19 22.38

Return on Assets % 4.38 4.76 4.69 7.39 1.46 2.68 6.63 2.18 3.84 3.22 3.1

Return on Equity % 10.35 12.16 12.65 18.6 3.63 7.34 19.91 7.02 12.77 10.56 10.23

Return on Invested Capital % 8.03 8.49 8.39 12.59 3.49 5.87 12.73 5.14 7.7 6.57 6.28

Gross profit margin

Gross profit margin % = Gross income/Sales

The gross profit margin is percentage amount of money required to cover operating expenses and yield a margin which exceeds the costs of goods sold. AT&T gross profit margin was highest in year 2007 and least in the year 2016. It is evident that the gross profit margin had a declining trend since 2013.

SG&A Margin

SG&A = (Expenses/Sales) %

It represents selling, general and administrative expenses. They are expenses which arise out of promotion, sales and delivery of products and services including the costs of running the operation of the company. They include commissions, advertising, promotional, rent, utilities as well as supplies. AT&Ts SG&A margin was highest in 2011 and least in 2013. The general trend in the SG&A an initial increase in margin levels followed by a decline in the SG&A margin since 2014.

Return on Assets %

Return on Assets % = Net Income/ Average Total assets

The Return on Assets % measures the amount of net income generated from the utilization of property during a given period. It is a measure of how efficient a company is at mobilizing its assets to generate the desired amount of revenue. AT&T utilized its assets most efficiently in 2010 since it had the highest ROA. On the other hand, it had the least ROA in 2011. The ROA increased from the year 2007 to the year 2010 after which it declined and waivered through the years before finally hitting a 3.22 percent in 2016.

Return on Equity %

Return on Equity= Income/ Equity

The return on equity (ROE) is a measure of the income amount drawn from investing in equity. AT&T had the highest ROE in 2015 and the least in 3.63. The ROE increased continuously from 2007 to 2010 before decreasing in 2011 and consecutively rising in 2012 and 2013. It dropped in 2014, increased in 2015 and finally declined in 2016. To improve the ROE, AT&T requires generating more income through its equity resources.

Return on Invested Capital %

Return on Equity= Income/ Shareholders Capital

It measures the level of profitability of the company regarding how profitably it invests funds it receives from shareholders. It is an indicator of the businesss management performance since it takes into account the fund's shareholders and bondholders put into the company to earn more profits. The ROIC (12.59) of AT&T was highest in 2009 while it was least (3.49) in the year 2011. Ideally, this shows that the company best utilized the shareholders money in the year 2009. The ROIC waivered over the years through a series of increase and decrease in ROIC.

Liquidity Ratios

According to Lewellen (2004), liquidity ratios are used by organizations and individuals in estimating the ability of the company in catering for the short-term and immediate needs.

2007

2008 2009 2010 2011 2012 2013 2014 2015 2016 TTM

Current Ratio 0.63 0.53 0.66 0.59 0.75 0.71 0.66 0.86 0.75 0.76 0.9

Quick Ratio 0.46 0.42 0.51 0.44 0.55 0.55 0.46 0.62 0.45 0.45 0.59

Current ratio =

Current ratio = current assets/ Current liabilities

The current ratio is an indication of the capacity of the organization in covering current liabilities using the current assets. AT&T had the highest current rate in 2014 and the least in 2008. The current rate increased and decreased through the years and finally recorded 0.76 in 2016.

Quick ratio

Quick ratio = (current assets- Inventory)/Current liabilities

The quick ratio is a marker of the ability of the company in paying off its current liabilities using its most liquid assets. In 2014, AT&T was in the best position to cater for its short-term obligations using readily convertible assets into cash. However, in 2008, the company has the least ability to pay its current liabilities out of its assets.

Leverage Ratio

Leverage ratios are a measure of the extent to which the company has taken a risk in financing its assets through debt and equity (DHulster, 2009).

Years 2007

2008 2009 2010 2011 2012 2013 2014 2015 2016 TTM

Debt/Equity 0.5 0.63 0.64 0.53 0.58 0.72 0.76 0.88 0.97 0.92 0.97

Debt to Equity ratio

Debt to Equity ratio = Total Debt / Total Equity

The total debt to equity ratio indicates the proportion of equity as compared to debt (Chen & Zhao, 2006). The company borrowed funds the most in 2015 with an aim of financing its operations. In 2007 however, AT&T borrowed the least funds to finance its activities.

References

Chen, L., & Zhao, X. (2006). On the relation between the market-to-book ratio, growth opportunity, and leverage ratio. Finance Research Letters, 3(4), 253-266.

DHulster, K. (2009). The leverage ratio. The World Bank Group, Financial and Private Sector Development Vice Presidency, Note, (11).

Fried, I. (2016). AT&T Adds 2.8 Million Customers but Wireless Revenue Falls. Retrieved from https://www.recode.net/2016/1/26/11589092/att-adds-2-8-million-customers-but-wireless-revenue-falls

Georgina Prodhan, G. (2016). AT&T exec says Internet of Things is a top priority. Retrieved from http://www.reuters.com/article/us-at-t-internet-idUSKCN0XO2DF

Lewellen, J. (2004). Predicting returns with financial ratios. Journal of Financial Economics, 74(2), 209-235.McFarlane, G. (2015). How AT&T Makes Money. Retrieved from http://www.investopedia.com/articles/investing/052214/how-att-came-serve-third-americans.aspMorning Star (n.d). AT&T Inc|T. Retrieved from http://financials.morningstar.com/ratios/r.html?t=TTamari, M. (1978). Financial ratios: Analysis and prediction. P. Elek.

Vault (n.d). AT&T INC.Retrieved from http://www.vault.com/company-profiles/telecommunications/att-inc/company-overview.aspx

Cite this page

AT&T Inc Company Financial Analysis Paper Example. (2021, Jul 02). Retrieved from https://midtermguru.com/essays/at-t-inc-company-financial-analysis-paper-example

If you are the original author of this essay and no longer wish to have it published on the midtermguru.com website, please click below to request its removal:

- The Campaign Program: Volunteer to Advance the Quality of Education

- Discussion of My Personal Progress in Research Process

- Admission Essay: Finance and Investment

- Principles to Good Qualitative Data Analysis

- Paper Example on Identifying Research Variables

- Trump Tax Reform: Reducing Taxes and Creating Jobs - Research Paper

- 3M: Gaining Success Through Key Presentations & More - Essay Sample