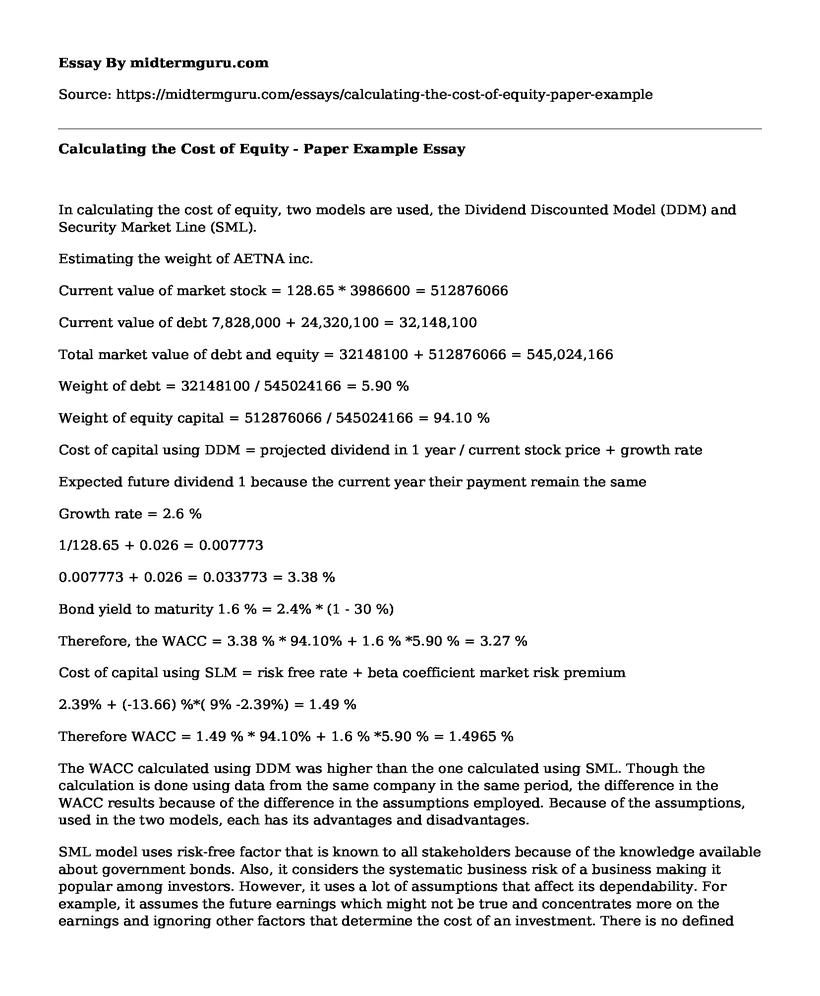

In calculating the cost of equity, two models are used, the Dividend Discounted Model (DDM) and Security Market Line (SML).

Estimating the weight of AETNA inc.

Current value of market stock = 128.65 * 3986600 = 512876066

Current value of debt 7,828,000 + 24,320,100 = 32,148,100

Total market value of debt and equity = 32148100 + 512876066 = 545,024,166

Weight of debt = 32148100 / 545024166 = 5.90 %

Weight of equity capital = 512876066 / 545024166 = 94.10 %

Cost of capital using DDM = projected dividend in 1 year / current stock price + growth rate

Expected future dividend 1 because the current year their payment remain the same

Growth rate = 2.6 %

1/128.65 + 0.026 = 0.007773

0.007773 + 0.026 = 0.033773 = 3.38 %

Bond yield to maturity 1.6 % = 2.4% * (1 - 30 %)

Therefore, the WACC = 3.38 % * 94.10% + 1.6 % *5.90 % = 3.27 %

Cost of capital using SLM = risk free rate + beta coefficient market risk premium

2.39% + (-13.66) %*( 9% -2.39%) = 1.49 %

Therefore WACC = 1.49 % * 94.10% + 1.6 % *5.90 % = 1.4965 %

The WACC calculated using DDM was higher than the one calculated using SML. Though the calculation is done using data from the same company in the same period, the difference in the WACC results because of the difference in the assumptions employed. Because of the assumptions, used in the two models, each has its advantages and disadvantages.

SML model uses risk-free factor that is known to all stakeholders because of the knowledge available about government bonds. Also, it considers the systematic business risk of a business making it popular among investors. However, it uses a lot of assumptions that affect its dependability. For example, it assumes the future earnings which might not be true and concentrates more on the earnings and ignoring other factors that determine the cost of an investment. There is no defined way of getting the market risk of security because all information is not available to the stakeholders. The market risk depends on an individual investors attitude towards risk and varies from one investor to the other, therefore, making the method to lack uniformity.

The DD model is simple to calculate and apply and does not require a lot of knowledge in finance to use it. It is applicable for use in most companies especial if the enterprise is mature. However, like SML model it uses a lot of assumptions for example in the estimation of future dividends and growth. Constant growth as assumed in the model normally is not practical and affects the accuracy of the method.

Cash flows

The company has experienced a relatively attractive growth in cash flows over the five years starting from the financial year 2011 to 2015 ("AET Income Statement | Balance Sheet | Cash Flow | Aetna Inc. Common Stock Stock - Yahoo Finance", 2016). In 2011, the company had free cash flow of $ 2.14 billion while in 2015 it was $ 3.5 billion. The growth in the cash flows was not constant over the five years, with a decrease in cash flows in 2013 and a record increase of $ 1.9 billion in 2012. A per the cash flows, the company operations signifies a healthy financial performance and management of cash. The company performance is relatively good, but there is a concern about the reliance on income from government sponsor coverage ("What Are Aetnas Key Risks? - Market Realist", 2016).

References

AET Income Statement | Balance Sheet | Cash Flow | Aetna Inc. Common Stock Stock - Yahoo Finance. (2016). Finance.yahoo.com. Retrieved 9 December 2016, from https://finance.yahoo.com/quote/AET/financials?p=AET

What Are Aetnas Key Risks? - Market Realist. (2016). Marketrealist.com. Retrieved 9 December 2016, from http://marketrealist.com/2015/03/aetnas-key-risks/

Cite this page

Calculating the Cost of Equity - Paper Example. (2021, May 26). Retrieved from https://midtermguru.com/essays/calculating-the-cost-of-equity-paper-example

If you are the original author of this essay and no longer wish to have it published on the midtermguru.com website, please click below to request its removal:

- Answers to Questions on Finance and Costs - Paper Example

- Government Intervention in Stabilizing the Market - Essay Sample

- Empowering Employees: Strategies for Leader Success - Essay Sample

- Unifying the Social World: How Labor Unites People from Diversified Backgrounds - Essay Sample

- Organizational Training: Enhancing Employee Development & Performance - Essay Sample

- History of Economic Thought: A Selective Overview - Essay Sample

- Verizon Wireless: Examining Fiscal Policy in a Competitive Market - Essay Sample