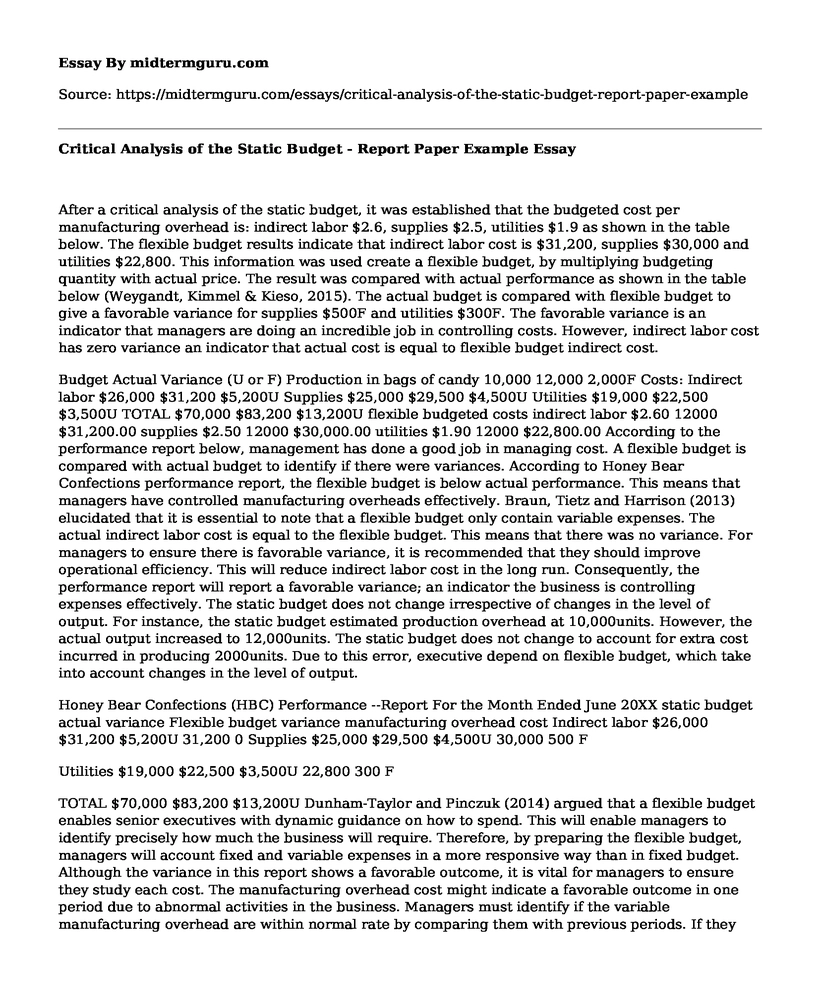

After a critical analysis of the static budget, it was established that the budgeted cost per manufacturing overhead is: indirect labor $2.6, supplies $2.5, utilities $1.9 as shown in the table below. The flexible budget results indicate that indirect labor cost is $31,200, supplies $30,000 and utilities $22,800. This information was used create a flexible budget, by multiplying budgeting quantity with actual price. The result was compared with actual performance as shown in the table below (Weygandt, Kimmel & Kieso, 2015). The actual budget is compared with flexible budget to give a favorable variance for supplies $500F and utilities $300F. The favorable variance is an indicator that managers are doing an incredible job in controlling costs. However, indirect labor cost has zero variance an indicator that actual cost is equal to flexible budget indirect cost.

Budget Actual Variance (U or F) Production in bags of candy 10,000 12,000 2,000F Costs: Indirect labor $26,000 $31,200 $5,200U Supplies $25,000 $29,500 $4,500U Utilities $19,000 $22,500 $3,500U TOTAL $70,000 $83,200 $13,200U flexible budgeted costs indirect labor $2.60 12000 $31,200.00 supplies $2.50 12000 $30,000.00 utilities $1.90 12000 $22,800.00 According to the performance report below, management has done a good job in managing cost. A flexible budget is compared with actual budget to identify if there were variances. According to Honey Bear Confections performance report, the flexible budget is below actual performance. This means that managers have controlled manufacturing overheads effectively. Braun, Tietz and Harrison (2013) elucidated that it is essential to note that a flexible budget only contain variable expenses. The actual indirect labor cost is equal to the flexible budget. This means that there was no variance. For managers to ensure there is favorable variance, it is recommended that they should improve operational efficiency. This will reduce indirect labor cost in the long run. Consequently, the performance report will report a favorable variance; an indicator the business is controlling expenses effectively. The static budget does not change irrespective of changes in the level of output. For instance, the static budget estimated production overhead at 10,000units. However, the actual output increased to 12,000units. The static budget does not change to account for extra cost incurred in producing 2000units. Due to this error, executive depend on flexible budget, which take into account changes in the level of output.

Honey Bear Confections (HBC) Performance --Report For the Month Ended June 20XX static budget actual variance Flexible budget variance manufacturing overhead cost Indirect labor $26,000 $31,200 $5,200U 31,200 0 Supplies $25,000 $29,500 $4,500U 30,000 500 F

Utilities $19,000 $22,500 $3,500U 22,800 300 F

TOTAL $70,000 $83,200 $13,200U Dunham-Taylor and Pinczuk (2014) argued that a flexible budget enables senior executives with dynamic guidance on how to spend. This will enable managers to identify precisely how much the business will require. Therefore, by preparing the flexible budget, managers will account fixed and variable expenses in a more responsive way than in fixed budget. Although the variance in this report shows a favorable outcome, it is vital for managers to ensure they study each cost. The manufacturing overhead cost might indicate a favorable outcome in one period due to abnormal activities in the business. Managers must identify if the variable manufacturing overhead are within normal rate by comparing them with previous periods. If they notice major differences, they should adjust the rates accordingly.

References

Braun, K. W., Tietz, W. M., & Harrison, W. T. (2013). Managerial accounting. Pearson.

Dunham-Taylor, J., & Pinczuk, J. Z. (2014). Financial management for nurse managers: Merging the heart with the dollar. Jones & Bartlett Publishers.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2015). Financial & Managerial Accounting. John Wiley & Sons.

Cite this page

Critical Analysis of the Static Budget - Report Paper Example. (2021, Jul 01). Retrieved from https://midtermguru.com/essays/critical-analysis-of-the-static-budget-report-paper-example

If you are the original author of this essay and no longer wish to have it published on the midtermguru.com website, please click below to request its removal:

- Importance of Limited Leverage to a Business - Paper Example

- Report on Canyon Creek Food Company Ltd

- The Cost of Capital - Paper Example

- Managing a Recession with a Low Interest Rate - Essay Sample

- Blockchain & Bitcoin: Revolutionizing Global Commerce & Finance - Essay Sample

- Workplace Incivility: A Growing Challenge in Our Organization - Essay Sample

- SWOT Analysis of Mystery Shop - Essay Sample