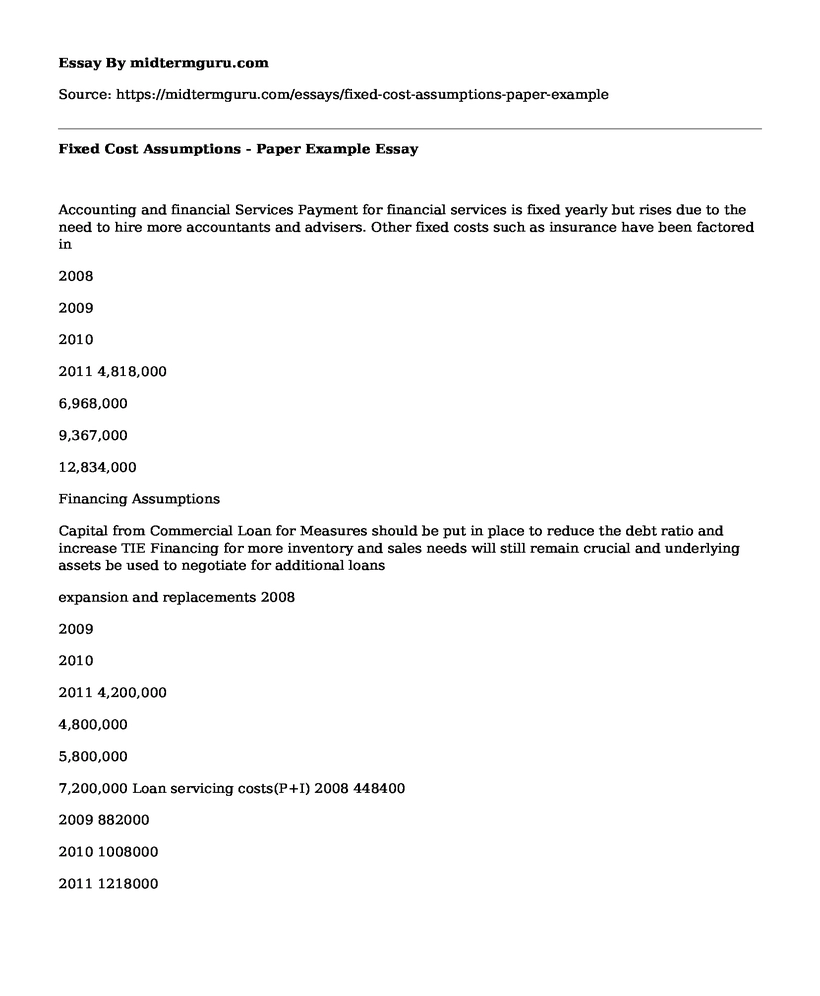

Accounting and financial Services Payment for financial services is fixed yearly but rises due to the need to hire more accountants and advisers. Other fixed costs such as insurance have been factored in

2008

2009

2010

2011 4,818,000

6,968,000

9,367,000

12,834,000

Financing Assumptions

Capital from Commercial Loan for Measures should be put in place to reduce the debt ratio and increase TIE Financing for more inventory and sales needs will still remain crucial and underlying assets be used to negotiate for additional loans

expansion and replacements 2008

2009

2010

2011 4,200,000

4,800,000

5,800,000

7,200,000 Loan servicing costs(P+I) 2008 448400

2009 882000

2010 1008000

2011 1218000

Principal is 10% previous gross debt Interest rate is 11%

Revenue from the sale of goods is highly likely to remain consistent as has been in the previous years, maintaining double digit growth rates. New product lines are going to be launched and the distributor is also looking to expand its market share. These initiatives should in the long run, maintain and add more revenue streams resulting to increased earnings over the coming years. It is expected that this increase by not less than 10% should continue in the next couple of years.

In line with sales forecasts, it is almost certain that the cost of goods coupled with the need to hire more people to offer financial services will also increase simultaneously. The accounting team needs to be able to extensively exhaust all the required statements needed for financial analysis. This has to be done since Cafe needs money managers who should help in drafting measures that will lower its debt ratio, increase TIE as its lenders require.

Stewart has been able to successfully negotiate for loans in the previous years. He faces a difficult task in the coming years asking for additional financing, crucial to help achieve sales forecasts. It is almost impossible that he wont reduce the debt ratio and increase TIE and this, by increasing the size of the accounting team and hiring financial advisory services should get this done so that sales is not affected by lack of enough financing. An increase in lending by almost $200,000 is needed in 2008 alone and with expansion still expected in the coming years, Cafe should still need even more financing for its projects. He could still negotiate for financing since underlying assets such as receivables that have been increasing in doubles in the preceding years are very likely to increase with expansion.

Cite this page

Fixed Cost Assumptions - Paper Example. (2021, Jun 03). Retrieved from https://midtermguru.com/essays/fixed-cost-assumptions-paper-example

If you are the original author of this essay and no longer wish to have it published on the midtermguru.com website, please click below to request its removal:

- Summary of Case 66C: Alvin Bruce and Square One Inc

- The Relationship Between Financial Reporting and Audit Quality - Essay Sample

- Critical Analysis of the Static Budget - Report Paper Example

- The Variance Calculation in Budgeting - Paper Example

- Paper Example on Pros and Cons of National Health Insurance

- Pay Taxes: Individuals' Responsibility to the State - Essay Sample

- Softbank and the Dynamic Equity Market - Essay Sample