Complete the following problems. You will likely use a spreadsheet for this assignment but you may choose to type up your answers in a Word document. In either case, be sure to show your work.

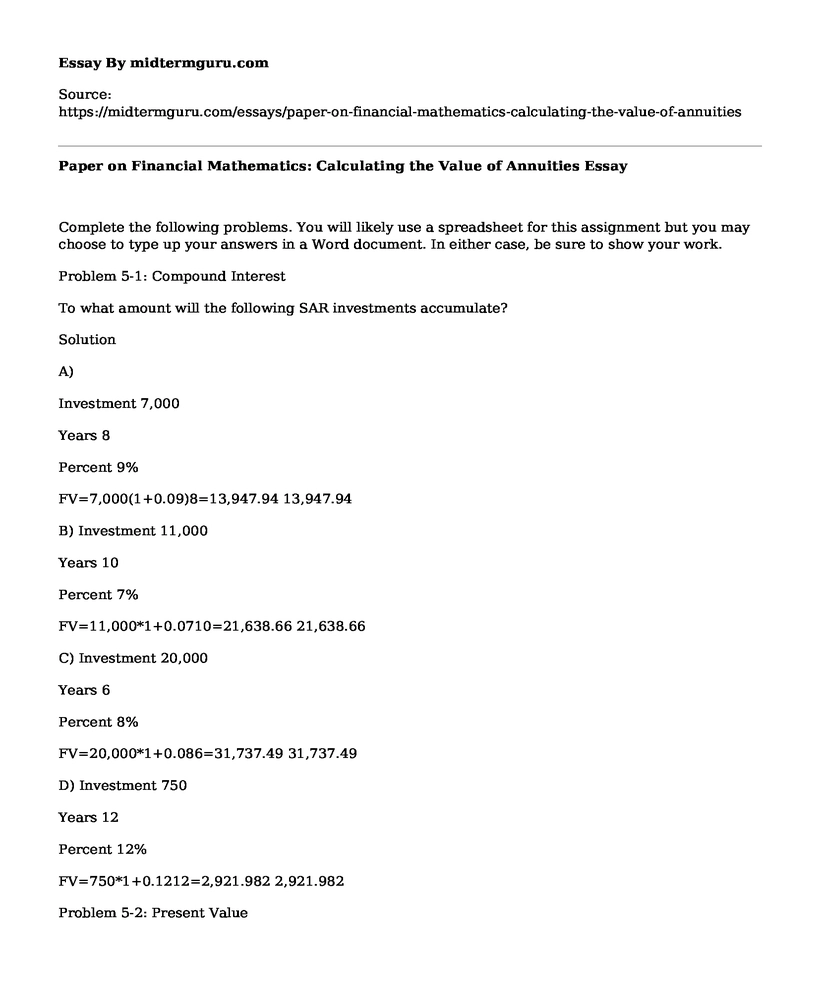

Problem 5-1: Compound Interest

To what amount will the following SAR investments accumulate?

Solution

A)

Investment 7,000

Years 8

Percent 9%

FV=7,000(1+0.09)8=13,947.94 13,947.94

B) Investment 11,000

Years 10

Percent 7%

FV=11,000*1+0.0710=21,638.66 21,638.66

C) Investment 20,000

Years 6

Percent 8%

FV=20,000*1+0.086=31,737.49 31,737.49

D) Investment 750

Years 12

Percent 12%

FV=750*1+0.1212=2,921.982 2,921.982

Problem 5-2: Present Value

What is the present value of the following future amounts?

A)

FV 1,200

Years 7

Percent 11%

PV=1,200(1+0.11)7=577.99 577.99

B) FV 400

Years 6

Percent 6%

PV=400(1+0.06)6=281.98 281.98

C) FV 1,500

Years 8

Percent 4%

PV=1,500(1+0.04)8=1,096.04 1,096.04

D) FV 2,500

Years 8

Percent 20%

PV=2,500(1+0.2)8=581.42 581.42

Problem 5-3: Future Value

Sales of a new finance book were 20,000 copies this year and were expected to increase by 15 percent per year. What are expected sales during each of the next 3 years?

DATA Copies 20,000

Percent 15%

Years 3

Solution

FV of 1st yr=20,000*1+0.151= 23,000 FV of 2nd yr=23,000*1+0.151= 26,450 FV of 3rd yr=26,450*1+0.151= 30,417.5 Problem 5-4: Present-Value Comparison

Assuming you can earn 9 percent on your money, which of the following offers should you choose? SAR 1200 today; SAR 12,500 in 11 years; or SAR 30,000 in 25 years?

Solution

Percent 9%

Years Amount PV

A Today 1,200 1,100.92

B 12 12,500 9,856.165

C 25 30,000 3,479.04

Which offer should you choose and why? I would choose offer c, since it requires low initial investment and provides a high future value due to the long holding period. The present value would be worth a large amount in 25 years time due to the time value of money.

Problem 5-5: Compound Annuity

What is the accumulated sum of each of the following streams of payments?

a. SAR 1,500 a year for 8 years compounded annually at 6 percent

b. SAR 1,000 a year for 6 years compounded annually at 12 percent

c. SAR 350 a year for 5 years compounded annually at 5 percent

d. SAR 125 a year for 4 years compounded annually at 4 percent

FV of compounded annuities=PV*(1+i)n-1iSolution

A)

Pymt 1,500

Years 8

Percent 6%

FV=1,500*1+0.068-10.06= 14,846.20

B) Pymt 1,000

Years 6

Percent 12%

FV=1,000*1+0.126-10.12= 8,115.19

C) Pymt 350

Years 5

Percent 5%

FV=350*1+0.055-10.05= 1,934

D) Pymt 125

Years 4

Percent 4%

FV=125*1+0.044-10.04= 530.81

Problem 5-6: Compound Interest with Nonannual Periods

a. Calculate the future sum of SAR 7,000, given that the money will be held in the bank for 5 years at an annual interest rate of 6 percent.

b. Recalculate part a. assuming the interest rate is (1) an APR of 6 percent compounded semiannually and (2) an APR of 6 percent compounded bimonthly.

c. Recalculate parts a. and b. for an APR of 12 percent

d. Recalculate part a. using a time horizon of 12 years (the APR is still 6 percent).

e. With respect to the effect of changes in the stated interest rate and holding periods on future sums in parts c. and d., what conclusions do you draw when you compare these figures with the answers found in parts a. and b.?

Solution

A)

PV 7,500

Years 5

Percent 6%

FV=7500*1+0.065=annual 10,036.7

B)

semiannual FV=7500*1+0.0625*2=

bimonthly 2 8,075.22

FV=7500*1+0.0665*6=6 10,108.87

C) Rate 12%

FV=7500*1+0.125=annual 13,217.56

FV=7500*1+0.1225*2=Semiannual 13,431.36

FV=7500*1+0.1265*6=bimonthly 13,585.21

D) Years 12

AnnualFV=7500*1+0.0612= 15,091.47

E) An increase in the annual interest rate results in an increase in the future sums given the same amount of initial investment and period of time.

A reduction in the holding period results in an increase in the future sums when the initial investment and rate of interest are held constant.

References

Carther, S. (2017). How to Calculate the Value of Annuities. Investopedia. Retrieved 23 February 2017, from http://www.investopedia.com/articles/03/101503.asp

Pournara, C. (2013). Mathematics-for-teaching in pre-service mathematics teacher education: The case of financial mathematics (Doctoral dissertation).

Pournara, C. (2014). Mathematics-for-teaching: insights from the case of annuities: original research. pythagoras, 35(1), 1-12.

Cite this page

Paper on Financial Mathematics: Calculating the Value of Annuities. (2021, Jun 04). Retrieved from https://midtermguru.com/essays/paper-on-financial-mathematics-calculating-the-value-of-annuities

If you are the original author of this essay and no longer wish to have it published on the midtermguru.com website, please click below to request its removal:

- Paper Sample: Intuition in Maths and the Role That It Plays in This Field

- Essay Sample: International Financing Reporting Standards Versus German German Handelsgestestzbuch

- Forecasting Case Study Paper Example: Urban Planning

- Essay Sample on Accounting for Leases

- Critical Essay on From Dust to Life: the Origin and Evolution of Our Solar System

- The CO2, N2O and N2, Food Charges - Research Paper

- Human Agency in Anthropology: Free Agent or Social Structure? - Essay Sample