1. (a) Premium This is a bond whose trading value is above its par value. In other instances, bond value can be identified if the bond value is higher than the face value of the bond at the time of issuance (Warren, 2017).

Discount A bond which is issued at a rate which is lower than its par value in a secondary market is referred to as a discount bond (Warren, Reeve & Duchac, 2009). A discount bond is one which usually has a lower interest rate than the market rate.

During the period in 1999, the investors demanded 9%. The investors made a bid of $908.24, and later sold it at $1,000 (par value). Therefore, the bond issued ($908.24) was a discount bond, which achieves the par value when it gets to its period of maturity.

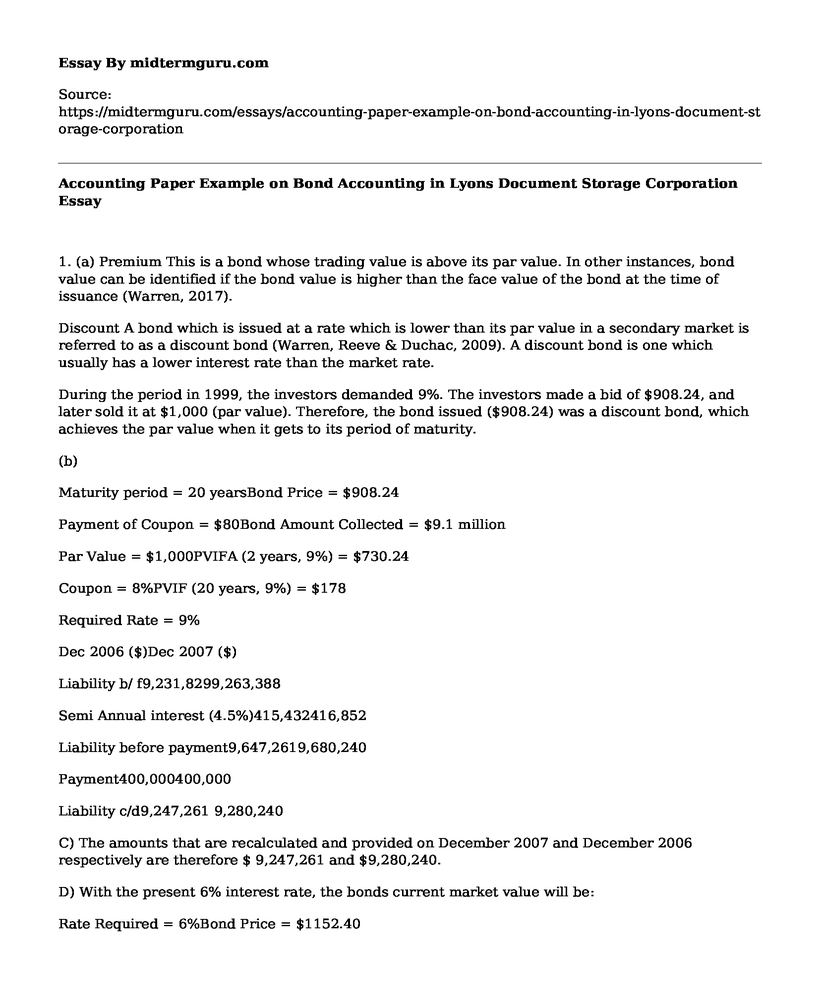

(b)

Maturity period = 20 yearsBond Price = $908.24

Payment of Coupon = $80Bond Amount Collected = $9.1 million

Par Value = $1,000PVIFA (2 years, 9%) = $730.24

Coupon = 8%PVIF (20 years, 9%) = $178

Required Rate = 9%

Dec 2006 ($)Dec 2007 ($)

Liability b/ f9,231,8299,263,388

Semi Annual interest (4.5%)415,432416,852

Liability before payment9,647,2619,680,240

Payment400,000400,000

Liability c/d9,247,261 9,280,240

C) The amounts that are recalculated and provided on December 2007 and December 2006 respectively are therefore $ 9,247,261 and $9,280,240.

D) With the present 6% interest rate, the bonds current market value will be:

Rate Required = 6%Bond Price = $1152.40

Coupon = 8%PVIFA (10 1/2 years, 6%) = $609.88 million

Maturity = 20 yearsBond Amount = $11.5 million

Par Value = $1,000PVIF (10 1/2 years, 6%) = $542.50 million

Coupon Payment = $80

2) The effect of issuing new bonds

Coupon Rate = 6%Bond Price = $1,000

Required Rate = 6%PVIF (6%, 10 1/2 years) = $558

Par Value = $ 1,000PVIFA (6%, 10 1/2 years) = $442

Maturity = 10 yearsOverall Amount Collected = $ 10 million

Payment of coupon = $60

The retained earnings of the company will be used to meet the difference of $1.52 million. For the repayment of the old bond the company will have to find $11.52 million as compared to the $10 million collected by the company (Bruns, 2010).

Balance Sheet for the issuance of a new bond of $ 10 million

Items 2006 ($) 2007 ($) 2008 ($) 2009 ($)

Long term debt 9,247 9,316 9,356 10,000

Current Liabilities 12,704 12,995 12,995 12,995

Total liabilities 21,951 22,311 22,351 22,995

Retained Earnings 146,530 151,279 151,279 149,755

Common shares 2,839 2,839 2,839 2,839

Additional payments 75,837 75,837 75,837 75,837

Shareholders equity 225,205 229,954 229,954 228,430

shareholders equity & Liabilities 247,156 252,265 252,305 251,425

The coupon interest in 2006 will affect the retained earnings significantly reducing them.

If the company decides to remain with the ongoing bond the it will have such a cash flow:

Duration

No of Payments02/07/2009 to 02/07/2019

Total semi-annual Payments22

Present value of Payments$8,400,000

Final value (Present Value)$3,122,544

The current value is $ 9,288,553

If the company decides to issue a $ 10 million coupon rate of 6% the new bond will be:

Year02/07/2009 to 02/01/2019

Number of Payments20

Coupon Payment$5,700,000

Present Value of Payment$4,171,980

Final settlement (Present Value)$5,583,948

The loss from the company that will arise from the old bond will be paid from the companys reserve (Bruns, 2010).

The difference between the old market price bonds ($11,523,800) and the 2008 financial year liability ($9,316,254) is $2,207,546

On the other hand, the difference between the old bond, present value annuity and single lump ($9,288,553) and the sum and the new bonds ($9,755,928) is computed to be -$ 467,375

Issuing the new bond will result in a net saving of -$ 0.267 million

It is not advisable to issue a new bond since it could lead to an increased loss to the company.

3) The retained earnings will be significantly reduced to $ 692,000 in 2010 after the coupon payments as the last retained earnings will be $ 150,587,000.

If the company chooses to issue a new bond for $11.54 million at a discounted rate of 6% and an expired market rate of 6% the present value annuity will be as follows

Year02/07/2009 to 02/01/2019

No. of Payments20

Coupon Payment$6,924,000

Present value Payment$5,150,582

Present Value of final amount$6,443,876

The calculated present value of the lump sum and the annuity is $ 11,594,458. By issuing a new bond all amounts to the old investors will be paid out. Since the new bond is valued at $11.54 million the calculated saving of the new bond will be -$ 2,305,905.

The difference between the new bond of 10 million at present value ($11594458) and the old bond at current value ($9,288,553) is $2,305,905.

Since the net savings from the new bond will be -$2,305,905, it will not be advisable to issue a new bond.

References

Bruns, W. (2010). Lyons Document Storage Corporation: Bond Accounting. Harvard Business School, 1-7.

Warren, C. S. (2017). Financial & managerial accounting. Place of publication not identified: Cengage Learning.

Warren, C. S., Reeve, J. M., & Duchac, J. E. (2009). Accounting. Mason, OH: South-Western Cengage Learning.

Cite this page

Accounting Paper Example on Bond Accounting in Lyons Document Storage Corporation. (2021, Jun 17). Retrieved from https://midtermguru.com/essays/accounting-paper-example-on-bond-accounting-in-lyons-document-storage-corporation

If you are the original author of this essay and no longer wish to have it published on the midtermguru.com website, please click below to request its removal:

- Paper on Financial Mathematics: Calculating the Value of Annuities

- Essay on Accounting and the Environment

- Essay on Regulations in Accounting and Finance That Impact on the United States Postal Service (USPS)

- Revised Code of Ethics: Benefits for Professional Accountants in the US - Research Paper

- Walmart Can Benefit From Activity-Based Costing (ABC) - Essay Sample

- JNJ's Current Ratio: 2018-2016 Trend Analysis - Essay Sample

- Essay Sample on Facebook and Advertisement