The level of competition and innovation in the corporate sector has presented a new dimension regarding the introduction and management of new products in the market. Working with a specific approach to ensure high profits are attained is focused on the ability of the firm to understand the nature of implication on the market generated by the differentiated brands in the market. For a business that deals with multiple products, the contribution of each brand is essential for the increasing revenue; however, considering each design assist in creating appropriate strategic marketing techniques that can attract high rates of customer acquisition and retention (Boyd and Headen, 2000). Therefore, the most significant need for corporate firms in this competitive era is to understand the nature of lifecycle of the brands they are dealing with, the market demands, and the prioritization of the product portfolio management (PPM) dimensions as the basis for strategic marketing. This essay presents a critical evaluation of PPM in line with the product lifecycle with the objective of presenting general industry-based recommendations for strategic marketing.

Product portfolio management is a method employed in the production of good and services with the aim of prioritizing the brand that is associated with the highest returns. Therefore, the technique includes the identification of the gaps in the industry based on the needs of the enterprise and the expectations of the segmented market (Boyd and Headen, 2000). In such a case, the marketing and product design experts present a series of decisions, which creates the need for strategic choices. Capitalizing on the advantage of the expertise and experience on market shift analysis is equally essential; therefore, the firm might decide to produce a variety of different line products. The existence of such a tendency, therefore, calls for practical product management expertise (Boyd and Headen, 2000). The success of the organization will be inclined to the capacity of the management regarding the product position and target for each product, which forms the baseline for portfolio planning and implementation. Product portfolio management is a multidimensional approach to brand conglomerate balance with the objective of keeping the profit margin of the organization sustainable.

Moreover, when considering the justification of strategic PPM within any framework of an organization regardless of the sector, then several core factors cannot be ignored. The management of a single or a line of products in the market is founded on the desire to determine and monitor the value of the product to guarantee sustainability and competitive advantage. The organization is therefore mandated by three major undertakings to ensure that the first market performance is subjected to improvement (Doorasamy, 2015). The first consideration of product portfolio management is the section and maximization of the brands in the market based on the profitability targets and performance indicators. The allocation of resources, technical, financial, and human, assist in ensuring the balance between the marginal cost and opportunity cost does not compromise the revenue brackets. The final part of the process involves the execution and management of the choices and production projects (Doorasamy, 2015). The changing markets trends should be incorporated to ensure that the targeted customers still prefer the brands over the alternatives available in the market. For example, competitive industries such as the motor vehicle or beverage production require constant product innovation that correlates to the tastes and preferences of the customers. Proven approaches consider cross-departmental, multi-production, and introduction timeframes for brands as critical factors that complement planning, resource allocation, and project management in PPM (Boyd and Headen, 2000; Jae-Woong, 2016).

Worth pointing out is that the reason behind PPM emphasis is the nature of the lifecycle common to most generic products in the corporate sector. The industry of operation does not eliminate the tendency of a new brand in the market undergoing the four broad phases of development and growth categorized in line with the revenue and market share. At the initial stage of investment, the product is new in the market, and customers curiosity and purchasing power encourage high sales (Emarald Insights, 2002). The level of impacts of the marketing techniques promotes a high level of returns emanating from a growing customer acquisition pool and retention ability. In such a case, the quality of the product is supreme, and the brand is identified as the market leader. Therefore, after the introduction, the products are associated with an escalating rate of growth, which is the second phase of the cycle. The limited competition in the market encourages the continuous revenue sustainability generated from the sales. However, the firm is not assured of the continuous advantages of the constant growth since externalities of market and industry instability eventually alter the trend. Hence, the product is set for the maturity stage (Emarald Insights, 2002).

Moreover, at maturity stage, little implications are attained from the measures used to increase further growth. At the maturity level, most of the privileges associated with market dominance start decreasing because other investors have begun joining the market. The standard of competition gradually becomes stiff. Eventually, the product advances to declining stage characterized by continuous low revenue (Emarald Insights, 2002). Additional investment in product development for the brand has little or no significant influence on customers. The quick recovery technique is the designing of another product of re-investing the brand to depict the needs and expectations of the customers. The earlier the organization recognizes that the service or commodity is advancing to declining stage re-engineering and technology-based innovation becomes handy is incorporating market shifts for competitive advantage and high customer satisfaction (Giachetti and Dagnino, 2015). However, few organizations have the capacity to shield their profitability from the externalities of the unstable product lifecycle (Emarald Insights, 2002). Nevertheless, comprehensive analysis, planning, and implementation that favors the positioning of different products of an organization in the market can enable the firm to enjoy the continuous profit. Tools and models established through comprehensive research have been essential in aligning the strategies of the organization to the structure and resources without losing the dimensions of the market perspectives.

The origin of the Boston Consulting Group product portfolio management model was based on the effect of volume and cost as elements of revenue margin. The experience curve and the effect of economies of scale in line with industrial shifts and growth became the building blocks of product management and strategic marketing. The BCG model looks at growth and market share as the key determinants of product performance. Based on the approach, firms are subjected to capitalize on resources to ensure that the goods in the market remain as leaders with high revenue and share control (Eggers, 2006; Ma, 2016). Competitive advantage, therefore, is key to the portfolio management in BCG model. For example, based on the nature of the product lifecycle, a firm with multiple line brands in the market can look at their performance from the revenue trends associated with each type of goods. With appropriate managerial expertise, the organization will establish the interrelation between cost and resource allocation related to the product, which must include the positioning and market segmentation factors (Kester et al., 2011). Therefore, the decision will be confined to introducing a new product, improving the existing one, enhancing marketing strategy, or disinvesting the product based on the objective of the firm as well as the internal and external environment factors.

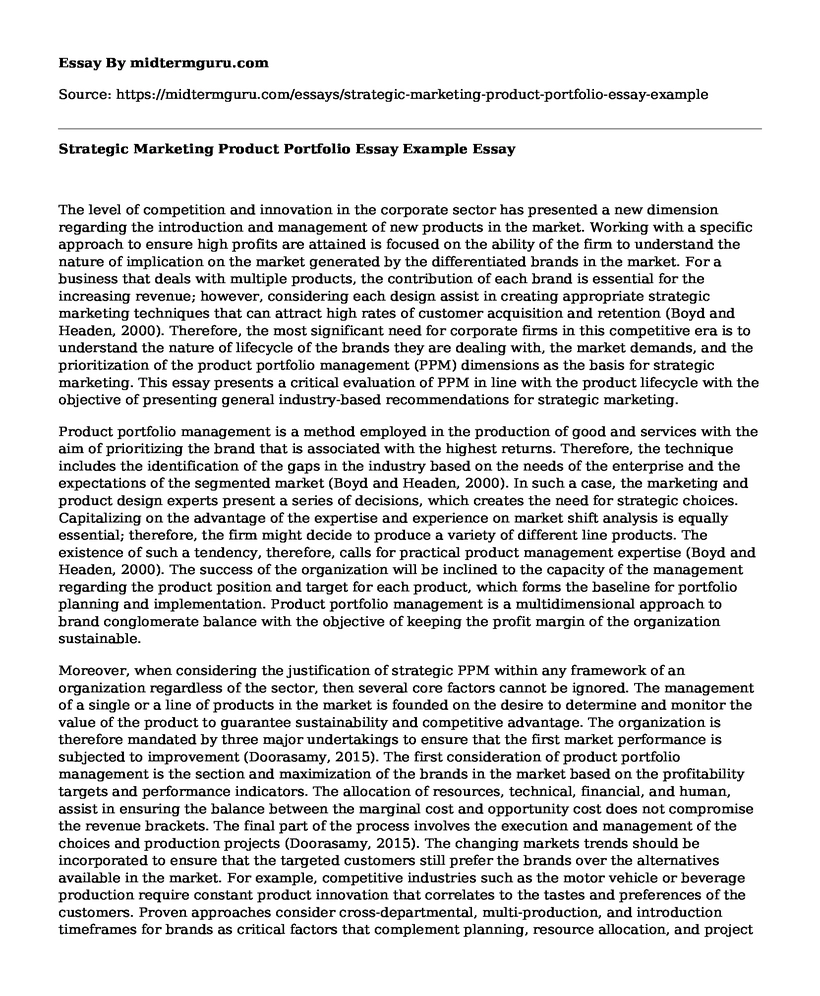

Worth noting is that BCG product portfolio model is founded on two market dimensions only with four product positions in the market. When looking at the dimensions of the model critical factors of growth and market share correlate to economies of scale. The changes in fixed and overhead costs distribution and efficiency of large scale production define the extent of revenue through cost management. The use of technology is critical in maintaining the quality of products, which calls for increasing specialization (Giachetti and Dagnino, 2015). A keen analysis of the bargaining power of the firm vis-a-vis the suppliers is another dimension that cannot be ignored. Moreover, utilization capacity contributes to the nature of growth that will be attained (Kester et al., 2011). Since the proportionality of these elements of the scale of operation is not uniform across industries and within the organization then a product may fall into four broad categories, which the BCG model designate in a matrix. Based on the matrix a product can be considered as a star, a problem child, a cash cow, and a dog. The figure below illustrates the matrix elements.

Figure 1: BCG Growth-Share Model (By Author)

HIGH GROWTH The Star - Cash Neutral

High growth high low share

Strong positioning and competitive advantage

Customer preference

High growth high low share

Strong positioning and competitive advantage

Customer preference

The Problem Child - Cash Absorbing

High growth low market share

Product innovative development can revive market control

High growth low market share

Product innovative development can revive market control

LOW GROWTH The Cash Cow - Cash Generating

High growth high share

Limited or no competition

Maximum returns reached

High growth high share

Limited or no competition

Maximum returns reached

The Dog - Cash Neutral Final

Low growth Low market share

Weak competitive advantage

Lower profitability

Consider disinvesting

Low growth Low market share

Weak competitive advantage

Lower profitability

Consider disinvesting

HIGH MARKET SHARE LOW MARKET SHARE

Since multiple performance determinants characterize a corporate market, then the limitation of the BCG model limits organizations is viewing products regarding growth and market share only. The model restricts product performance to a cycle of shifts from the star, cash cow, problem child, and finally to the dog where the circle begins again. Therefore, the directional policy matrix included additional market factors, which generated the qualitative aspect of the market rather that the fixative quantity-based analysis (Kester et al., 2011; Yang et al., 2007). When viewing a market from multiple dimensions while including both numerical and non-numeric assessments then it becomes easy to predict performance and develop risk management framework (Ma, 2016; McNally, Durmusoglu, and Calantone, 2012). Such advantages could not be depicted when strategic marketing decisions are confined to growth and market share control. For example, in the motor industry, focusing on market share and growth could present product management challenges; however, a comprehensive consideration that factor potential risks, future customer and market trends, and possible shifts in competition hierarchy is critical for sustainable growth. The directional matrix, a masterpiece of Paul Gordon and Joseph Guiltinan, consider the vertical axis to represent the business sector factors while the horizontal axis is used to present the business position (Kester et al., 2011). Therefore, the enhanced growth-share interrelation could include a range of intermediary var...

Cite this page

Strategic Marketing Product Portfolio Essay Example. (2021, Jun 11). Retrieved from https://midtermguru.com/essays/strategic-marketing-product-portfolio-essay-example

If you are the original author of this essay and no longer wish to have it published on the midtermguru.com website, please click below to request its removal:

- Essay on the Impact of Service Marketing Mix on Customer Satisfaction

- N05 LEAU as a Product of the Chanel Company Analysis - Paper Example

- Analysis of the Impact of Marketing Communication on Financial Performance With Respect to G2G Company

- Essay Sample on Multicultural Advertising Agencies

- Essay Sample on Apple: Inclusion & Diversity-Open

- Price Optimization: Balancing Distribution & Marketing Strategy - Essay Sample

- Are Advertisements Aimed at Teenagers Effective? - Essay Sample